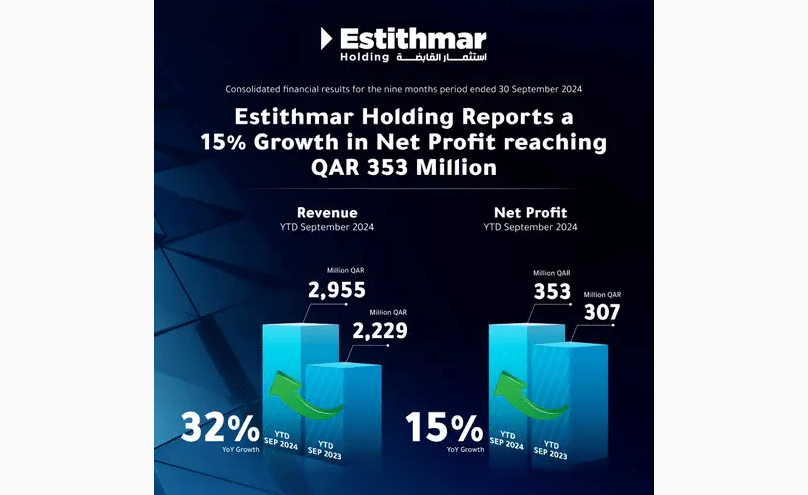

Estithmar Holding Q.S.P.C has reported a strong financial performance for the nine months ending September 30, 2024, showcasing growth across its main divisions, including healthcare, real estate, tourism, services, and specialised contracting. The company saw a notable increase in net profits, up by 15% to QAR 353 million compared to QAR 307 million in the same period in 2023. Revenues also rose by 32% to QAR 2.9 billion, and gross profits grew by 26% to QAR 719 million. Earnings before interest, taxes, depreciation, and amortisation (EBITDA) reached QAR 573 million, while earnings per share increased by 11% to QAR 0.099. The results, surpassing prior projections, are attributed to successful project development and effective operational policies.

In healthcare, Estithmar’s subsidiary Apex Health reported considerable growth driven by the ongoing enhancement of healthcare properties across the region. Estithmar’s hospitals, including The View Hospital in partnership with Cedars-Sinai and the Korean Hospital, have set high-performance standards in Qatar, reflecting patient trust in the company’s healthcare services. Development progress was reported on the Algerian Qatari German Hospital, which aims to elevate healthcare in Algeria. Additionally, Apex Health continues to manage and operate the Imam Al-Hassan Al-Mujtaba Hospital and Al-Nasiriya Teaching Hospital in Iraq.

Estithmar’s tourism sector has also shown promising results, largely driven by the Al Maha Island project, which draws an average of 10,000 visitors daily, with an increase expected as Qatar’s cooler fall and winter seasons attract more tourists. The company is also preparing for the third season of Lusail Winter Wonderland, a popular attraction in Qatar. Meanwhile, in Iraq, construction continues on the Rixos Baghdad project, which aims to introduce world-class residential and hospitality experiences. Estithmar also has plans underway for a luxury tourism project, the Rosewood Maldives, expected to attract high-end visitors to the resort island destination.

The services sector expanded its regional footprint with new operations in Saudi Arabia, bolstering revenue and profits with strong local demand for catering and facilities management services in Qatar and Jordan. These offerings have attracted local and regional clients and are expected to contribute to revenue growth into 2024.

Estithmar’s specialised contracting sector has continued its successes with an expanded role in Saudi Arabia, particularly in landmark projects such as NEOM, the Red Sea, and Amaala. Subsidiary Elegancia Arabia has taken on major contracts in Saudi Arabia’s urban development initiatives, including mechanical, electrical, and plumbing (MEP) works, airport fit outs, and residential facilities. This expansion has positioned Estithmar as a trusted partner in delivering essential infrastructure for some of the Kingdom’s high-profile projects.

The company’s increasing international credibility is marked by the recent listing of QAR 500 million in sukuk on the London Stock Exchange—the first sukuk to be listed in Qatari riyals on the LSE. Attracting significant interest from both governmental and private investors, the sukuk underscores Estithmar’s rising profile in international markets. Additionally, a memorandum of understanding with the Italian SACE Group for financial insurance aims to support the company’s expansion plans and facilitate the export of Italian goods and services through Estithmar’s channels.

Estithmar’s robust nine-month performance reflects the success of its growth strategy and reinforces the company’s position as a leading player in healthcare, tourism, services, and specialised contracting sectors across the region.