The UK rental market is a dynamic landscape. It offers diverse opportunities for investors seeking rental income. Understanding rental yields is crucial for making informed investment decisions.

Rental yields indicate the return on investment from rental properties. They are a key metric for property investors. Comparing yields globally can reveal lucrative markets.

In 2025, the UK rental yields are expected to face new challenges and opportunities. Economic and political events will shape these yields. Investors must stay informed to navigate these changes.

This article provides a detailed comparison of UK rental yields with global markets. It offers insights into regional trends and high-yield areas. We will explore factors influencing yields and potential growth.

Discover how UK property yields stack up against other countries. Learn about emerging markets with high rental yields. This guide is essential for anyone interested in the global rental market.

What Is Rental Yield and Why Does It Matter?

Rental yield is a critical measure in property investment. It represents the return on investment from a rental property. Essentially, it is the annual rental income expressed as a percentage of the property’s value.

Understanding rental yield helps investors evaluate property profitability. It guides decisions on buying and selling real estate. High rental yields often signal lucrative opportunities in the property market.

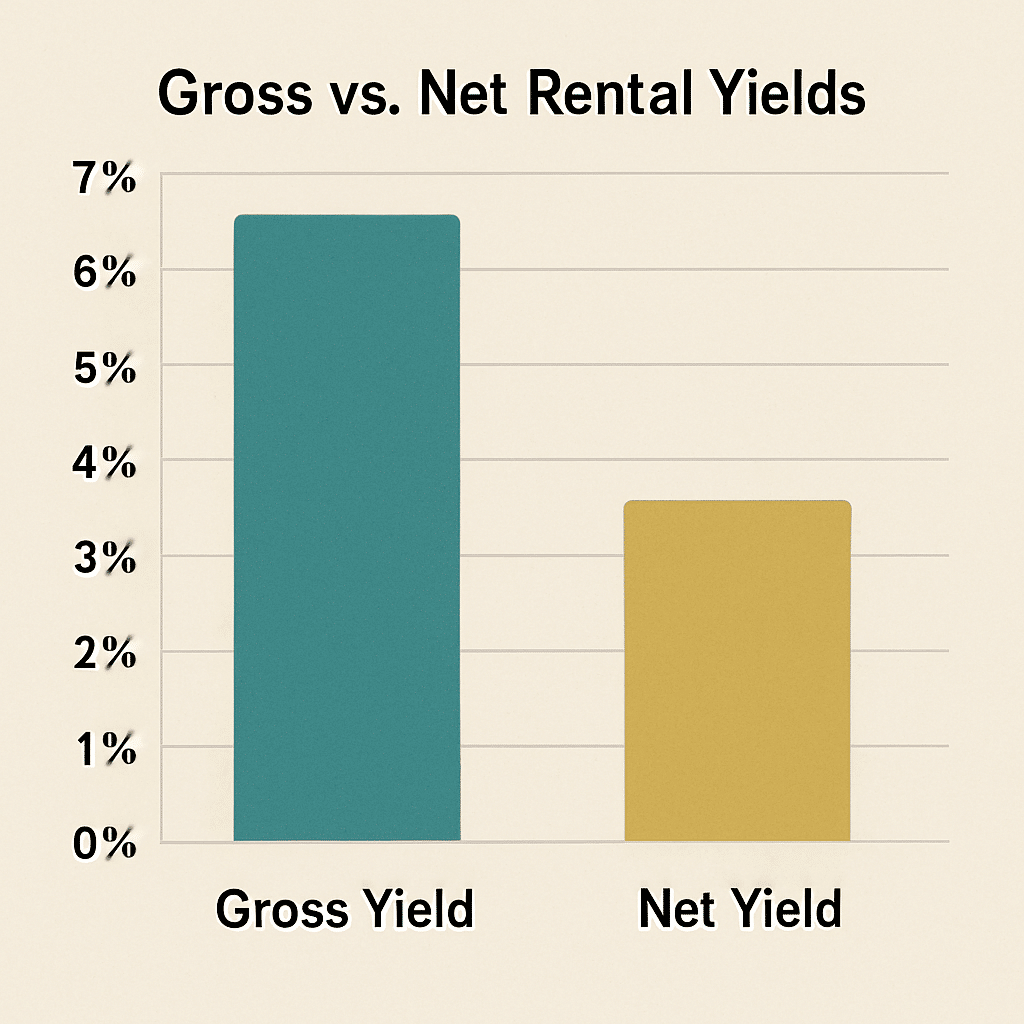

There are two main types of rental yields:

- Gross Rental Yield: Calculated before expenses.

- Net Rental Yield: Takes into account all expenses, providing a clearer profit picture.

Rental yield matters because it reflects market demand and pricing trends. In a high-yield area, rental demand typically matches or exceeds supply. This metric helps investors spot areas with strong potential for growth and profitability.

How Rental Yields Are Calculated: Gross vs. Net

Calculating rental yields involves considering two types: gross and net. Gross rental yield is simpler to compute. It divides the annual rental income by the property’s purchase price.

Net rental yield provides a more accurate assessment. This involves subtracting operating expenses from rental income first. Consider costs such as maintenance, insurance, and property taxes.

Here are the steps for calculation:

- Gross Yield: ((Annual Rent / Property Value) \times 100)

- Net Yield: (((Annual Rent – Expenses) / Property Value) \times 100)

These calculations aid investors in understanding potential profit margins. Choosing between gross and net yields depends on individual financial goals.

The UK Rental Market in 2025: Key Trends and Regional Breakdown

In 2025, the UK rental market shows notable trends. Urbanization continues, driving demand in major cities. Regions exhibit varied performance in rental yields.

The market faces challenges from rising interest rates. However, demand remains robust, buoyed by the rental culture. Economic factors, such as inflation, have their influence.

Technology reshapes property management. Digital platforms streamline processes, benefiting landlords. Tenants enjoy a smoother, more efficient renting experience.

Government policies play a crucial role. Changes in tax legislation impact net yields. Investors need to adapt to new regulations.

A diverse range of rental yields exists across the UK. High-yield areas offer lucrative opportunities. However, regions with lower yields might ensure stability.

Key trends impacting yields include:

- Urbanization: Increasing city dwellers.

- Technology: Enhanced property management tools.

- Economic factors: Interest rates and inflation shifts.

Understanding these elements helps investors make informed decisions. The regional analysis emphasizes the variation within the UK.

Regional Rental Yield Comparison: England, Scotland, Wales, and Northern Ireland

Rental yields vary significantly across UK regions. Each region presents unique opportunities and challenges.

England’s yields fluctuate, with the North often leading. Urban areas show potential despite high property prices. In Scotland, yields generally remain stable with Edinburgh and Glasgow being notable hotspots.

Wales sees competitive yields, especially in Cardiff. Northern Ireland offers favorable conditions. However, yields can differ within cities.

Key regional insights:

- England: Variability, North leads.

- Scotland: Steady, with urban hotspots.

- Wales: Competitive, Cardiff is key.

- Northern Ireland: Favorable and competitive.

Top UK Cities and Postcodes for Buy-to-Let Yields

Certain cities in the UK stand out for buy-to-let investment. Birmingham and Manchester offer attractive returns. High student populations and economic activity contribute to this.

Liverpool delivers high yields, appealing to investors. Its cultural renaissance creates rental demand. London remains strong, despite high prices, due to ongoing demand.

Top yielding postcodes often lie in commuter belts. Proximity to transport links enhances appeal. These areas combine convenience with potential for rental growth.

Leading cities and postcodes:

- Birmingham: Vibrant rental market.

- Manchester: High yields and demand.

- Liverpool: Cultural and economic incentives.

- London: Consistently strong despite costs.

UK Rental Yields vs. Global Markets: Country-by-Country Comparison

As 2025 unfolds, UK rental yields present a competitive landscape globally. Investors seek robust markets that balance risks and returns. Comparing these yields to international figures is key for understanding global property dynamics.

The UK shows moderate yields, attractive due to political stability. Yet, some countries offer higher returns. Understanding these contrasts can guide investment strategies.

Yields in European markets vary. France and Germany present different opportunities than Spain and Eastern Europe. Economies in North America offer contrasting yields, especially in the US and Canada.

In the Asia-Pacific, markets such as Australia and Singapore attract investors. Emerging markets in this region also provide interesting prospects. Meanwhile, the Middle East and Africa reveal certain hotspots with higher yields.

Key comparative factors include:

- Economic stability: Impacting investor confidence.

- Market dynamics: Shaping yield potential.

- Legislative environment: Affecting net returns.

Investors must weigh these against personal risk preferences. Global variations in yield allow diverse portfolio management approaches. Understanding these nuances aids informed decision-making.

Europe: Comparing UK Yields to France, Germany, Spain, and Eastern Europe

European rental yields present a diverse picture. The UK’s yields are competitive but lower than some Eastern European countries. France and Germany offer moderate yields, driven by stable, mature markets.

Spain’s yields are appealing for higher returns. The market is recovering, and demand is rising. Eastern Europe, especially countries like Poland, shows strong yield potential due to economic growth.

Notable contrasts in yields:

- France & Germany: Stability with moderate yields.

- Spain: High growth potential.

- Eastern Europe: Emerging opportunities.

Market dynamics reflect diverse economic landscapes. Tailored strategies are key for maximizing returns in these regions.

North America: UK vs. US and Canada Rental Yields

Rental yields in North America differ from the UK. The US offers varied returns across states, with some areas providing higher yields than the UK. Canada, however, presents a stable market with slightly lower yields.

Investor interest in North America is notable due to large market size. Portfolio diversification and risk management are crucial here.

Key North American features:

- US: Diverse yields across states.

- Canada: Stability over high returns.

Asia-Pacific: UK vs. Australia, Singapore, and Emerging Markets

In Asia-Pacific, Australia and Singapore dominate rental discussions. Australia shows strong yields similar to the UK, driven by urban demand. Singapore’s yields are stable but lower, reflecting high property costs.

Emerging markets, such as Vietnam, display attractive yields. Economic growth drives demand here. Understanding these markets offers growth potential for investors.

Regional insights include:

- Australia: Competitive and resilient.

- Singapore: High stability.

- Emerging Asia: High growth opportunities.

Middle East, Africa, and Latin America: High-Yield Hotspots

Rental markets in the Middle East, Africa, and Latin America offer high-yield possibilities. While the UK’s stable returns appeal, these regions attract risk-tolerant investors.

The UAE leads in the Middle East, offering promising returns. Africa’s burgeoning urban centers present yield potential. Latin America’s volatility provides risks but also potential rewards.

Key high-yield regions:

- UAE: Leading Middle East yields.

- Africa: Emerging urban opportunities.

- Latin America: Volatile, rewarding markets.

These locations are ideal for those seeking diversification. Navigating risks involves understanding local dynamics and regulations.

Factors Influencing Rental Yields in the UK and Abroad

Several factors affect rental yields, both in the UK and globally. Understanding these elements helps investors make informed decisions.

Economic conditions often have a significant impact. Changes in employment rates, inflation, and economic growth directly influence rental demand and supply. This can lead to fluctuations in rental yields over time.

Location is another crucial factor. High-demand areas typically offer lower yields due to high property costs. In contrast, emerging regions might provide better returns but with added risks.

Government policies and tax regulations also play a role. In the UK, landlord-friendly laws can increase yield potential. Abroad, varying taxation and regulations dictate the profitability of rental investments.

These factors include:

- Economic conditions

- Location

- Government policies

Balancing these elements with investment goals is essential for maximizing returns.

The Impact of Economic and Political Events on Rental Yields

Economic and political climates significantly influence rental yields. Investors must monitor these factors closely.

Recessions typically lead to lower yields as unemployment rises. People are unable to afford high rents, decreasing demand.

Political events, such as Brexit, alter investor confidence and market stability. These changes impact property prices and rental rates.

Key effects include:

- Altered property demand

- Fluctuations in currency values

- Changes in investor confidence

Understanding these dynamics allows investors to anticipate shifts and adjust strategies accordingly.

Buy-to-Let Yields: Trends, Risks, and Opportunities for Investors

Buy-to-let investments continue to allure investors with promising yields. As the property market evolves, new trends influence profitability.

In 2025, high-demand areas showcase healthy rent appreciation. Urban centers and developed suburbs often provide stable income streams.

Nonetheless, risks abound. Economic instability and regulatory changes pose threats to returns. Property investment experts can help landlords navigate these challenges.

Key trends and considerations include:

- Growing demand for short-term rentals

- Shifts towards sustainable properties

- Increasing regulation impacting profits

Opportunities are plentiful for the astute investor. Identifying emerging hotspots and diversifying portfolios enhances potential gains.

Smart investing requires vigilance and agility in navigating market fluctuations.

Maximizing Rental Income: Tips for UK and International Investors

Maximizing rental income requires strategic planning and market insight. Investors can boost returns by focusing on high-demand locations and maintaining property appeal.

Understanding market trends and tenant preferences is crucial. Savvy landlords adapt quickly to changes and tenant expectations.

Consider these tips for optimizing rental income:

- Regular property upgrades

- Competitive pricing strategies

- Efficient property management

By using these strategies, landlords can maintain and increase their yields. Staying informed about market dynamics ensures sustained profitability.

The Future of UK Rental Yields: Outlook for 2025 and Beyond

The UK rental market shows signs of steady growth. Factors like urbanization and increased demand support this trend.

Technological advancements also play a key role. They streamline property management and attract tech-savvy tenants.

Key elements shaping future rental yields include:

- Economic conditions

- Policy changes

- Shifts in tenant demographics

Investors should stay agile and informed. By anticipating trends, they can capitalize on emerging opportunities.

Conclusion: Key Takeaways for Global Rental Yield Comparison

In 2025, UK rental yields remain competitive yet diverse. Global comparisons reveal varying returns across regions.

Investors should focus on understanding unique market dynamics. A well-informed approach enhances investment success.

Consider these crucial points:

- Monitor global market trends and developments.

- Analyze location-specific factors affecting yields.

- Stay updated with economic and political shifts impacting returns.

By keeping these in mind, investors can make strategic, informed decisions.