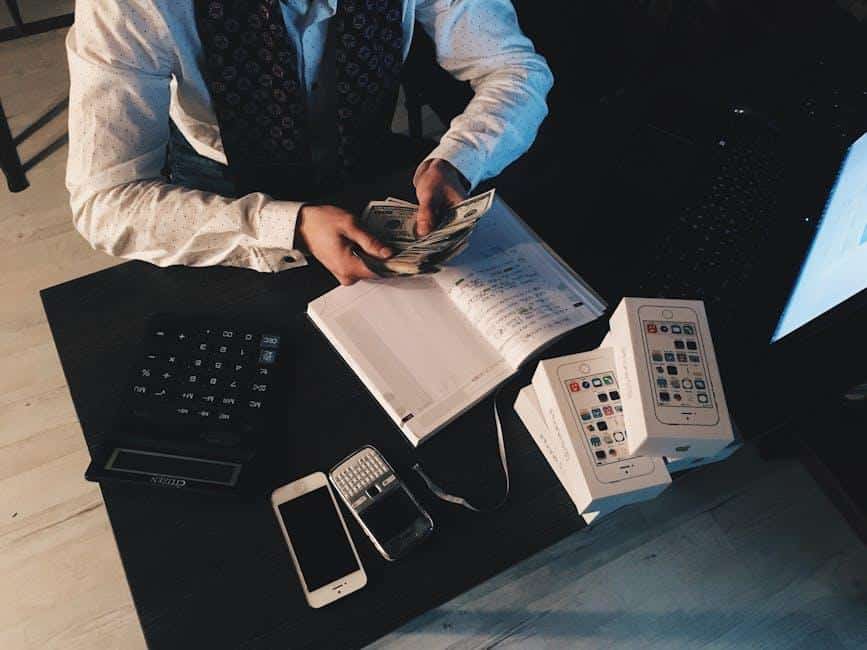

A business doesn’t falter on good intentions—it stumbles because the cash dries up. The real world turns on timing, unpredictability, and decisions made in the trenches, not just in boardrooms. There’s a restless energy to managing cash flow effectively, an art that is backed by discipline. Some simply watch the numbers; others predict what those numbers will do next week or next quarter. That’s where real resilience lives. Pillars hold up more than buildings—they keep entire operations from collapsing when conditions change. Understanding these pillars is no longer optional. It’s essential for any enterprise hoping to outlast its competitors—or survive at all.

- Know What Comes In (and When)

Revenue is not just a number scrawled on a spreadsheet—it’s the lifeblood of every business day. Surprisingly, money fluctuates at unpredictable times, particularly for those who are less experienced in this field. This is where reputable accounting firms, such as GSM Accountants, have repeatedly observed businesses faltering: misinterpreting revenue patterns can lead to the omission of warning signs before they become apparent. Upon closely examining invoices, payment terms, and actual receipts, one often discovers discrepancies that most people tend to ignore after the initial excitement fades. Every late payment undermines stability, and every early windfall encourages hasty decisions. The clever move is never assuming regularity—tracking helps spot trouble brewing before it derails growth entirely.

- Control What Goes Out

Expenses don’t care about forecasts—they arrive whether there are plans for them or not. Office rent requires regular attention, but have we considered the impact of increasing subscriptions or unexpected supplier price hikes? Every ambitious expansion plan or minor operational tweak approved last quarter often conceals hidden costs. A rigorous approach goes beyond reducing visible expenses; it explores opportunities to enhance efficiency in both routine purchases and renegotiated contracts. Bold businesses question each outgoing pound, treating resources as precious rather than plentiful—even during prosperous periods that lull weaker operators into complacency.

- Time Is Not On Your Side

Delays cause more damage to balance sheets than disastrous ideas, as timing determines the success or failure of a strategy before anyone realises what went wrong. Cash flow can be hindered by slow-paying customers or bureaucratic invoice cycles that drag on endlessly, while payroll deadlines remain as immovable as stone walls. Rapid invoicing matters far more than many admit; chasing overdue payments isn’t desperate—it’s smart management in disguise. Savvy organisations build buffers so that setbacks don’t rampage through their planning like a bull loose in a china shop—plenty talk about contingency funds, but few treat them as non-negotiable.

- Plan For Tomorrow Today

No crystal ball can anticipate which clients will disappear or what global crises will disrupt a business overnight, but smart CEOs refuse to operate blindly. Forecasting begins with honest assessments of historical performance and realistic forecasts based on present reality, not shareholder wishful thinking. Periodic changes keep plans flexible without compromising decision-makers’ trust, who must act quickly when circumstances change or opportunities arise.

Conclusion

The discipline of cash flow distinguishes those who survive from those who are merely dreamers—a harsh reality that most entrepreneurs discover only after facing a challenging situation or experiencing failure. Strong processes banish nasty surprises and generate clarity amid confusion when markets wobble or internal chaos threatens order itself. Pillar by pillar, companies construct resilience not from theory but through direct action—tracking, controlling, and adjusting at every stage—not someday, but today and tomorrow, together, if they’ve any sense at all.

Image attributed to Pexels.com